In today’s digital age, financial security has become paramount, and the BVN check is a crucial aspect of this security in Nigeria. The Bank Verification Number (BVN) serves as a unique identifier for banking customers, ensuring that all financial transactions are safeguarded. In this article, we will delve into what BVN is, how to perform a BVN check, its importance, and the implications of having a BVN in Nigeria.

This article aims to provide a thorough understanding of BVN checks, addressing common questions and concerns surrounding the topic. Whether you are a bank customer, a financial professional, or simply someone interested in learning more about Nigeria's financial systems, this guide is designed to enhance your knowledge and understanding of BVN checks.

By the end of this article, you will have a clear perspective on the BVN, how it works, and its significance in maintaining the integrity of the banking system in Nigeria. Let’s explore the world of BVN checks!

Table of Contents

- What is BVN?

- Importance of BVN

- How to Check BVN

- BVN Check via USSD

- BVN Check Online

- Common Issues and Solutions

- BVN Security Tips

- Conclusion

What is BVN?

The Bank Verification Number (BVN) is an 11-digit number that serves as a unique identifier for bank customers in Nigeria. It was introduced by the Central Bank of Nigeria (CBN) in 2014 as a means to curb fraud and enhance the security of banking transactions. Every individual with a bank account in Nigeria is required to register for a BVN.

Key Features of BVN

- Unique Identification: Each BVN is unique to an individual, preventing identity theft.

- Protection Against Fraud: BVN helps to reduce banking fraud and enhances the safety of transactions.

- Streamlined Banking: Customers can access multiple bank services using one BVN.

Importance of BVN

BVN plays a significant role in the Nigerian banking system for various reasons:

- Fraud Prevention: BVN minimizes the risk of fraudulent activities by verifying the identity of bank customers.

- Creditworthiness: Financial institutions use BVNs to assess the creditworthiness of individuals before granting loans.

- Financial Inclusion: BVN promotes financial inclusion by allowing previously unbanked individuals access to banking services.

How to Check BVN

Checking your BVN is a straightforward process that can be done through various methods. Below are the most common ways to check your BVN:

Methods of Checking BVN

- USSD Code

- Online Banking

- Bank Branch Visit

BVN Check via USSD

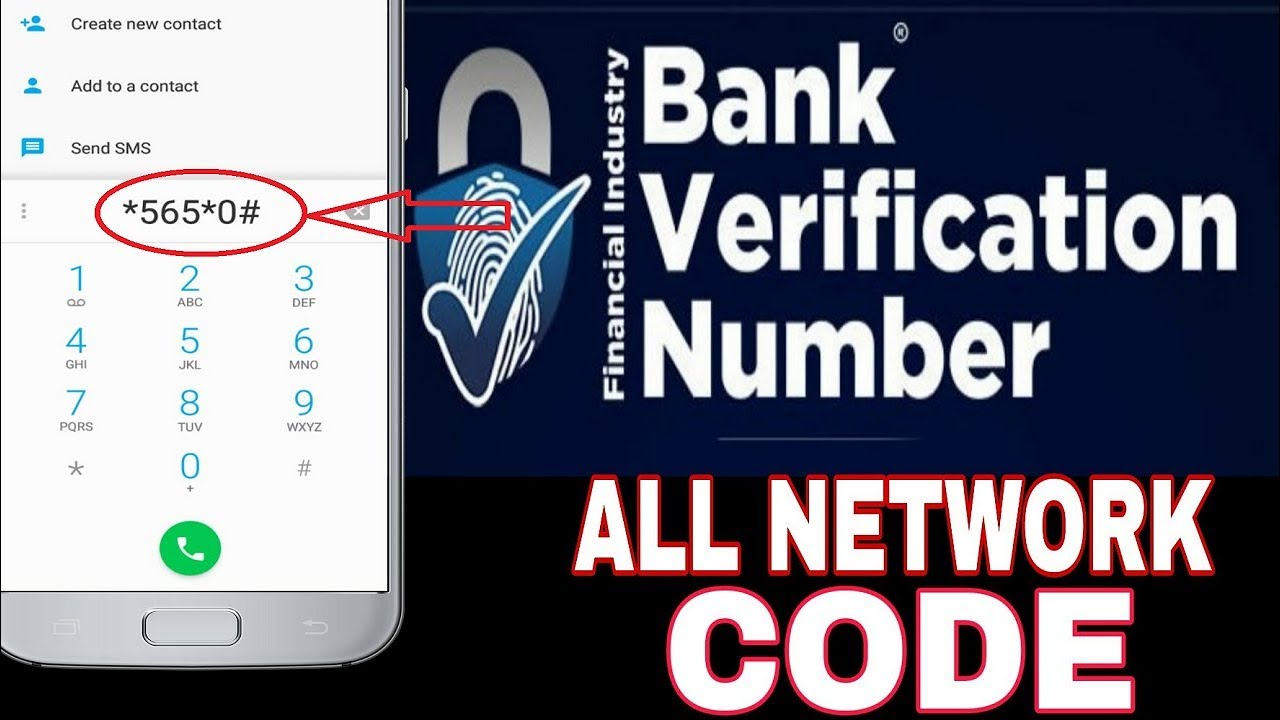

One of the easiest ways to check your BVN is through USSD codes. Most Nigerian banks offer a specific USSD code that allows customers to retrieve their BVN easily. Here’s how to do it:

- Dial *565*0# on your mobile phone.

- Follow the prompts to retrieve your BVN.

BVN Check Online

Another method to check your BVN is through your bank’s online banking platform. Here’s how you can do it:

- Log in to your bank’s online banking portal.

- Navigate to the BVN section.

- Enter your details as prompted, and your BVN will be displayed.

Common Issues and Solutions

While checking your BVN is generally a simple process, some common issues may arise. Here are a few issues and their corresponding solutions:

- Incorrect BVN: Ensure that you enter the correct details when checking your BVN.

- Network Issues: Poor network connection can hinder the process. Try again later.

- Unregistered BVN: If you do not have a BVN, visit your bank to register.

BVN Security Tips

To ensure your BVN remains secure, consider the following tips:

- Never share your BVN with anyone.

- Use strong passwords for your banking accounts.

- Regularly monitor your bank statements for any unauthorized transactions.

Conclusion

In conclusion, the BVN check is an essential aspect of banking in Nigeria. It provides a unique identification system that enhances security, prevents fraud, and promotes financial inclusion. By understanding how to check your BVN and the importance it holds, you can take proactive steps to safeguard your financial identity.

We encourage you to leave a comment below, share this article with your friends, or read more articles on our site to stay informed about financial security and banking practices in Nigeria.

Final Thoughts

Thank you for reading! We hope you found this guide informative and helpful. Stay safe while managing your finances, and we look forward to seeing you back on our site for more insightful articles.

You Might Also Like

Grant Gustin Altezza: Everything You Need To Know About The StarWhat Is OANDA? A Comprehensive Guide To Online Trading

Exploring The Rise Of Ebony Galoe: A Comprehensive Guide

Birtay Wishes Paragraph For Girlfriend: Heartfelt Messages To Make Her Day Special

Kareem Abdul-Jabbar Jersey: A Comprehensive Guide To The Iconic Basketball Legend

Article Recommendations

- 7 Movierulz Telugu 2024

- Alex Start X New 2024 Age

- Graciebon Onlyfans Leaks

- Donald Trump Jr Kimberly Guilfoyle

- Angelaalvarez Onlyfans Leaked

- Jameliz Onlyfan Leak

- Salt Trick For Men

- Aubrey Plaza Nude Leak

- Laralane Onlyfans

- Binghamton Skipthegames